Keeping track of your finances shouldn’t be a hassle. With FAB Bank, you have multiple options to check your balance at your fingertips. Let’s explore the simple ways to stay in the know about your account.

In this blog post, we’ll explore the utility of FAB bank’s balance check feature for effectively managing your finances. We’ll discuss various methods to access this service, along with its features, benefits, and significance in staying financially informed.

FAB Bank Balance Check – Step by Step Guide

Accessing your FAB Bank balance is convenient and straightforward, with three popular methods available. You can check your balance through the FAB bank website, the FAB mobile banking app, or by visiting a FAB ATM.

- Checking Balance on the Website

- Checking Balance Using the FAB Mobile App

- Checking Balance Through an ATM

Below is a step-by-step guide for each of these methods:

Method 1. Using FAB Bank Website

If you don’t want to put the mobile app on your phone, you can use FAB bank’s website to check how much money you have.

Step 1: Go to the FAB website and find the card service page (Link given below). There are two empty boxes there. You need to fill them in and then sign in to your account.

Step 2: Put the last two numbers of your FAB card in the first box.

Step 3: Then, put the 16 digit Card ID number in the second box. You can find this number at the bottom of your FAB card, on the front.

Step 4: After you put in all the details, click on the ‘Login’ button.

Step 5: You’ll be taken to your account page. Here, you can see how much money you have in your FAB bank account right away.

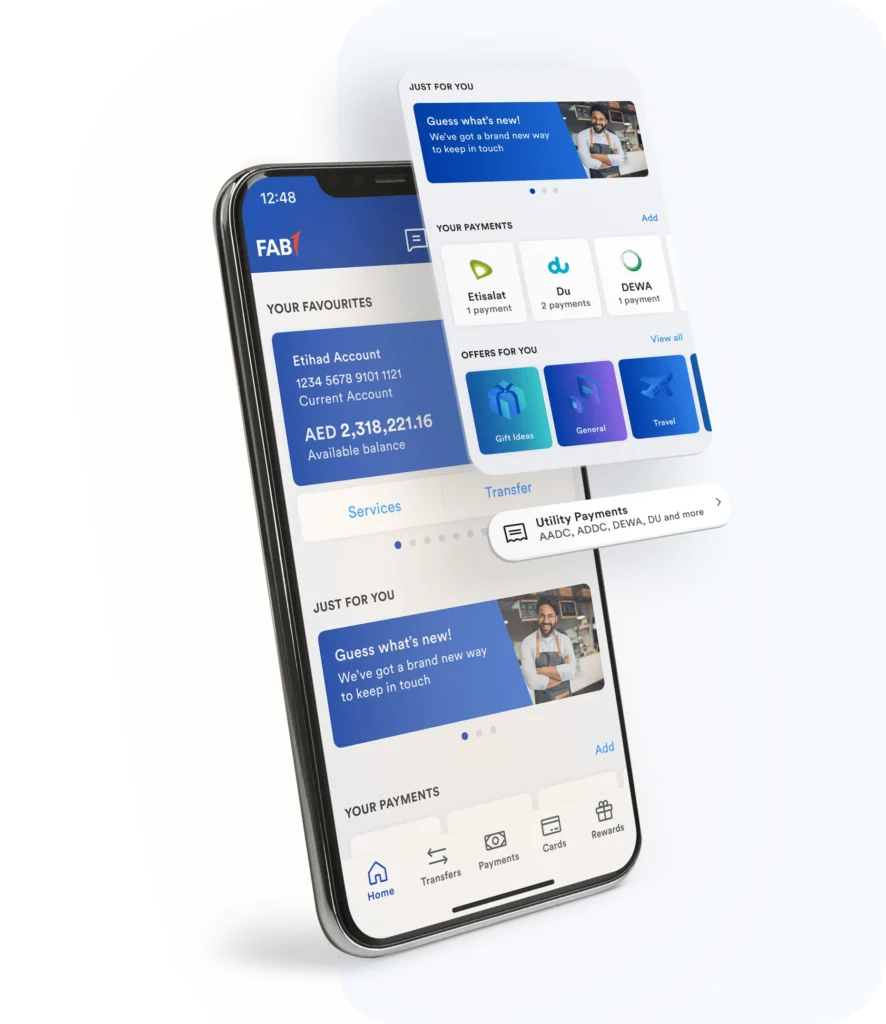

Method 2. Using FAB Bank Mobile App

If you want to keep an eye on your bank balance often, it’s a good idea to get the FAB Bank Mobile app. You can get it from the App Store for iPhones and the Play Store for Android phones.

Step 1: First, download the FAB Bank mobile app from your phone’s app store. You can use these links for the App Store (for iPhones) and the Play Store (for Android phones).

Step 2: After the app is downloaded, open it on your phone and sign in using your account details. If it’s your first time using it, you’ll need to enter your customer ID or debit card number, then the password sent to your phone or email. You’ll also need to create a 6-digit PIN for future logins.

Step 3: Once you’re logged in, you can see your account balance right on the homepage.

Step 4: The app also lets you check your past transactions and other account details.

Method 3: Using FAB Bank ATM

If you can’t get online or don’t have a mobile phone and want to check your bank balance offline, you can use a FAB Bank ATM.

Step 1: Go to the nearest FAB Bank ATM and put in your FAB Bank debit card.

Step 2: You’ll see different choices like taking out money, putting in money, and more. Pick the option that says ‘Check Balance’.

Step 3: The ATM will ask you to type in your ATM PIN. Do that, and your bank balance will show up on the screen.

FAB Bank Salary Account Balance Check

Do you have a salary account with FAB Bank? Don’t worry, checking your bank balance follows the same steps as mentioned earlier.

FAB Bank offers a special account for those who receive their salary directly into their account. This makes it easier for you to manage your salary and other money matters. However, the process to check your FAB bank balance is the same for all FAB bank accounts.

You can use any of the methods mentioned earlier, but the simplest way is through their official website.

FAB Bank gives a prepaid card to every customer with a salary account. This card makes it convenient to withdraw money or transfer it to other bank accounts. You can also use the prepaid card to shop online, in stores, and access various services.

With the details from your card, like the last two digits and the 16-digit Card ID number, you can easily log in to your account and check your salary balance online.

How to Open a FAB Bank Account?

If you’re interested in opening a bank account with FAB Bank, you can choose from various types such as salary, savings, or current accounts.

Here are four options to open an account with FAB Bank:

- Visit your nearest FAB Bank branch, fill out the required forms, and submit them along with the necessary documents.

- Fill out the online application form on the FAB Bank website.

- Download the FAB Bank mobile app, enter your details, and submit the application online to open your account.

- Call the FAB Bank customer service and complete the application over a phone conversation.

To open a bank account with FAB Bank, you need to verify your mobile number and provide necessary documents like identity and address proof.

Once your account is open and activated, you’ll receive a FAB Bank debit card. This card allows you to check your balance, withdraw money from ATMs, shop online, and make payments.

Open an account instantly with the FAB Mobile app

- Instantly open FAB account, no paperwork, just Emirates ID.

- Get credit card upon account opening.

- Use FAB Rewards for bill payments.

- Easily check balance, send money, and earn rewards.

How To Activate FAB Mobile Banking?

To start using FAB Mobile Banking, you must have a valid FAB Bank debit card. If you do, follow these steps:

Step 1: Get the FAB Bank mobile app from your phone’s app store. You can find it on both iOS and Android.

Step 2: Open the app and sign up for mobile banking.

Step 3: You’ll need to enter your debit card details and the OTP number sent to your registered phone or email.

Step 4: Create a new password for logging in by following the instructions on the screen.

After finishing the registration, you can use the FAB Bank app to check your balance, send money, and pay bills.

What is the minimum balance in an FAB account?

There’s no minimum balance needed for a regular FAB Bank account. However, if you have a personal savings account with FAB Bank, you’re required to maintain a minimum balance of 3000 AED.

If your balance falls below 3000 AED, a penalty of 10 AED per month will be charged.

If you’re only using your FAB Bank account for deposits and withdrawals, you don’t have to worry about a minimum balance. This is because the default account in this case is an Elite savings account, which doesn’t have a minimum balance requirement.

What Is FAB Swift Code?

The FAB Bank’s SWIFT Code is NBADAEAAXXX

SWIFT stands for Society For Worldwide Interbank Financial Telecommunication, a worldwide organization that ensures secure and dependable financial transactions.

This code specifies the bank branch to which money should be transferred. Each bank has its own unique SWIFT code, used for both domestic and international money transfers.

Whenever you send or receive money, you’ll need to provide the SWIFT code of the bank branch involved in the transaction.

FAB Customer Care Number

If you have any questions about FAB Bank services, you can reach out to their customer care team. You can give them a call at 600525500 or contact them through their website.

Here are the customer support details for FAB Bank:

Please note that the UAE number provided is only valid if you’re in the UAE. If you’re calling from abroad, you can reach them at +971 2 6811511.

FAQs

What is the minimum balance charge in FAB?

here is no minimum balance requirement in FAB bank if you own a by default provided saving account. However, if you own a personal saving account with FAB Bank, there is a minimum balance of 3000 AED that you need to maintain.

Which bank has Zero minimum balance in UAE?

iSave Account by Fab has No Minimum Balance

What is the minimum bank balance rule?

If your balance falls below 3000 AED, a penalty of 10 AED per month will be charged.

How much does it cost to close fab bank account?

AED 105 is charged for closing the account

![Company Revoke Job Offer Before Joining? [Solution]](https://magicaluae.com/wp-content/uploads/2024/02/Revoke-Job-Offer-Before-Joining-1024x683.jpg)