In a world of low-interest rates and complex banking rules, finding a savings account that works for you can feel like a hassle. You need a place to park your hard-earned cash, gain a decent return, and actually be able to access your money when you need it.

If you’re tired of watching your money stagnate in a traditional account, it might be time to discover the benefits of a high-yield savings account, like the FAB iSave Account.

Let’s explore why this type of account could be a game-changer for your financial goals.

What is a High-Yield Savings Account?

Unlike traditional savings accounts that often come with meager interest rates, high-yield savings accounts (HYSAs) offer considerably better returns. These are often offered by online banks or specialized accounts from traditional banks. Think of a HYSA as a boosted version of your savings, helping you fight inflation a bit better and reach your savings targets faster.

FAB iSave: A High-Yield Contender

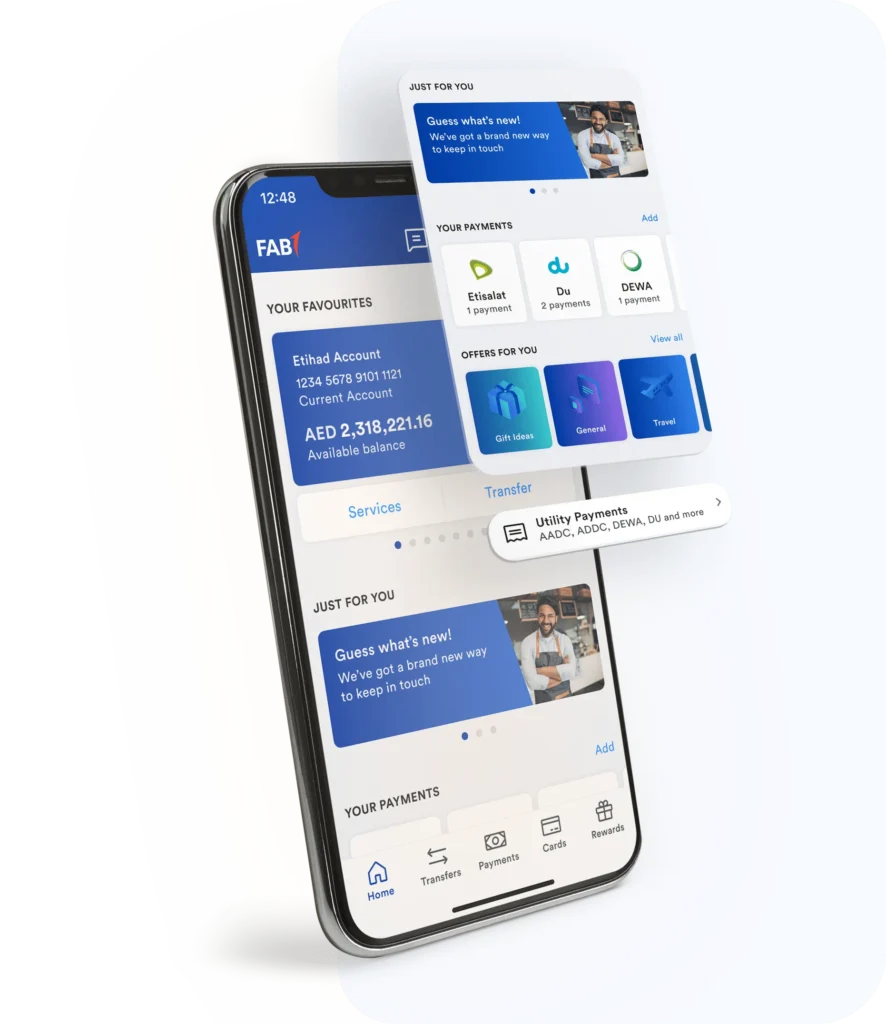

FAB’s iSave Account is a high-interest savings account that you can manage entirely online. Here’s a breakdown of its features:

- Competitive Interest Rate: Currently, you can earn 5.25% interest annually on any new funds deposited into your account between May 1, 2023 and March 31, 2024 [FAB iSave Account]. This applies only to new funds added, not your existing balance.

- No Minimum Balance: There’s no minimum amount you need to maintain in your iSave Account.

- No Monthly Fees: You won’t be charged any monthly maintenance fees for having this account.

- Unlimited Withdrawals: You can make unlimited withdrawals from your iSave Account without any restrictions.

- Online Account: You can open, manage and conduct transactions entirely online through FAB’s mobile app or online banking platform, making it very convenient.

Contents

Features & Advantages of FAB iSave Account

The FAB iSave Account offers a multitude of features and benefits designed to elevate your banking experience. Here are some key advantages:

Online Convenience

Forget about waiting in lines at bank branches. With the FAB iSave Account, you can handle all your banking needs online. From account management to transactions, everything is just a few clicks away from the comfort of your home.

Instant Account Opening

Opening an iSave Account is effortless, especially if you’re already a FAB customer. Simply download the FAB mobile app or access online banking to begin the process. Say goodbye to lengthy paperwork and time-consuming branch visits.

Single Currency Transactions

The FAB iSave Account operates exclusively in UAE Dirhams (AED), ensuring seamless transactions for Emirates-based customers.

No Minimum Balance Requirements

Unlike many other accounts that impose minimum balance requirements, the FAB iSave Account offers you the flexibility to manage your finances without such constraints.

Unlimited Withdrawals

Accessing your funds is easy with the FAB iSave Account, as there are no restrictions on the number of cash withdrawals. Your money is always readily available whenever you need it.

Eligibility Requirements for Application

Prior to applying for the FAB iSave Account, it’s essential to familiarize yourself with the eligibility criteria:

Average Monthly Balance

Your eligibility and the interest rate offered on your FAB iSave Account are influenced by the average monthly balance you maintain. Keeping a healthy balance can lead to benefits.

Minimum Age

You must be at least 18 years old to open an FAB iSave Account, adhering to FAB’s standard requirements for savings accounts.

Documents Needed for Application

To kickstart your journey with the FAB iSave Account, you’ll need to provide the following documents:

- Copy of Emirates ID, passport, or resident visa

- Completed application form

- Proof of income, such as a salary slip or income certificate from your current employer

How to Apply for the FAB iSave Account?

Acquiring the FAB iSave Account is a hassle-free process, achievable through two convenient avenues:

Apply via FAB Mobile App:

- Download the FAB mobile application from either the Android or iOS app store. Alternatively, scan the QR code provided on the official FAB webpage.

- Upon installation, access the app and sign in using your Emirates ID.

- Choose the FAB iSave Account option and proceed.

- Complete the requisite personal and employment details.

- Submit the online form, and your account will be promptly activated, primed for deposits and transactions.

Apply Online:

- Navigate to FAB’s official website and locate the Accounts section.

- Opt for the FAB iSave Account and furnish the lead form with your particulars.

- Following submission, anticipate a bank representative to reach out within 24 hours to facilitate your application.

Open an iSave Account instantly

- Open iSave Account instantly on FAB Mobile.

- Access FAB account, cards with no paperwork.

- Get account & card with Emirates ID.

- Use FAB Rewards for bill payments.

- Check balance, send money, earn rewards fast.

![Company Revoke Job Offer Before Joining? [Solution]](https://magicaluae.com/wp-content/uploads/2024/02/Revoke-Job-Offer-Before-Joining-1024x683.jpg)