The Al Ansari Salary Card Pay Plus is a payroll solution offered in collaboration with First Abu Dhabi Bank (FAB), tailored for UAE-based companies.

It simplifies salary disbursement by providing co-branded ATM cards, ensuring compliance with the Wages Protection System (WPS). Employers transfer salaries to Al Ansari Exchange, which distributes individual Pay Plus cards to employees.

In this guide, I will guide you to check Al Ansari PayPlus Card Balance Online.

Ensure you have the following items prepared before proceeding:

- Your Al Ansari PayPlus or PayRoll salary card

- Access to a computer, smartphone, or tablet with internet connectivity

- Your login credentials, including username and password

Check Al Ansari Salary Card Balance Using Mobile App

To begin checking your Al Ansari Salary Card balance using the mobile app, follow these straightforward steps:

To conveniently and efficiently check your Al Ansari Salary Card balance using the mobile app, follow these simple steps:

Download the Al Ansari Exchange Mobile App:

- Go to your smartphone’s app store (Google Play Store for Android or iOS App Store for Apple).

- Search for “Al Ansari Exchange” and proceed with the installation by tapping “Install” or “Download” for the official app.

Install and Open the App:

- Wait for the app to download and install.

- Tap the app icon to launch it.

Register or Log In:

- If it’s your first time, register by tapping “Register” and follow the on-screen instructions to set up your account.

- If you already have an account, simply log in with your username and password.

Navigate to the Dashboard:

- Once logged in, you’ll reach the dashboard or home screen.

Access Your Salary Card:

- Look for an option like “My Cards” to manage or view your salary card.

Select Your Salary Card:

- If you have multiple cards, choose the one linked to your salary.

Check Balance:

- Within the salary card details, find and tap “View Balance”.

View Your Balance:

- Your Al Ansari Salary Card balance will be displayed, showing the available funds.

Congratulations! You’ve successfully checked your Al Ansari Salary Card balance using the mobile app. This convenient method helps you keep track of your finances on the move. Remember to safeguard your login details and avoid sharing them to maintain account security.

Al Ansari Salary Card Balance Enquiry Online

To check your Al Ansari PayPlus or PayRoll card balance online, simply follow these steps:

Step 1: Visit the Al Ansari Exchange Website

Open your preferred web browser and navigate to the Al Ansari Exchange website. You can do this by entering “Al Ansari Exchange” in the search bar and selecting the official website link.

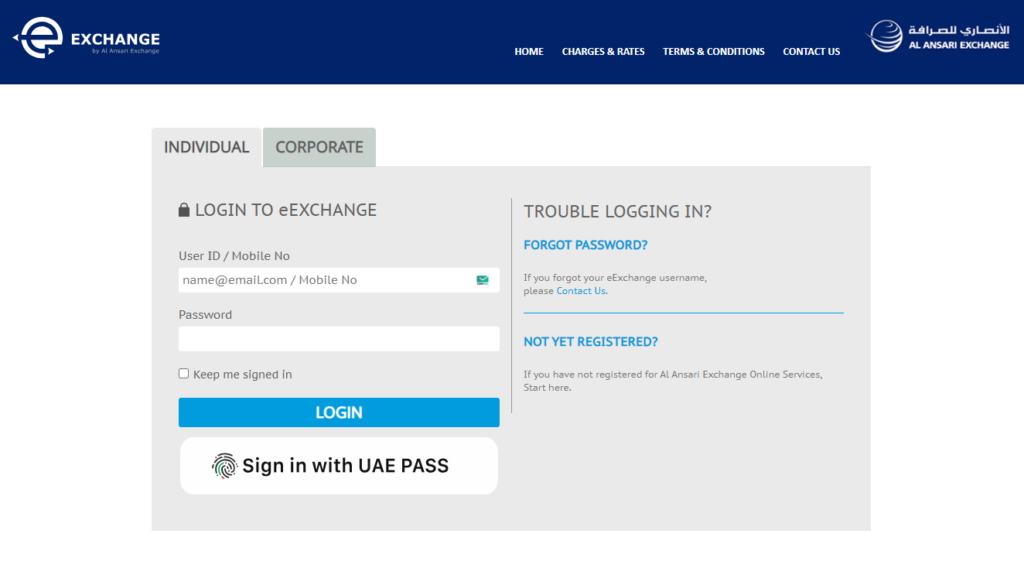

Step 2: Access the eExchange Portal

Once on the Al Ansari Exchange homepage, locate the “eExchange Portal” or a similar option designed for online services. This portal provides access to your salary card balance.

Step 3: Log In to Your Account

Click on the “Log In” button to enter your account. Provide your User ID and Password. If you haven’t registered for an online account yet, you may need to complete the registration process by providing the necessary information.

Step 4: Find the Balance Check Option

Upon successful login, navigate through the menu or dashboard to locate an option labeled “Check Balance” or similar, pertaining to your salary card.

Step 5: Select the Check Balance Option

Click on the “Check Balance” option, triggering a request to retrieve your current salary card balance.

Step 6: Review Your Balance

Within moments, your salary card balance will be displayed on the screen, indicating the available funds. This facilitates easy tracking of your financial status.

Step 7: Log Out

After verifying your balance matches your expectations, ensure to log out of your account to maintain security. Look for the “Log Out” option and click it to end your session.

The Al Ansari Salary Card Pay Plus Explained

The Al Ansari Salary Card Pay Plus is a payroll solution primarily aimed at companies in the UAE. Here’s a breakdown of what it is and how it works:

What it is:

- Co-branded ATM card: The Al Ansari Salary Card Pay Plus is a prepaid ATM card issued in collaboration with First Abu Dhabi Bank (FAB).

- Streamlined salary disbursement: It’s designed to make the process of paying employee salaries easier and more secure.

- WPS Compliance: It aligns with the Wages Protection System (WPS) mandated by the UAE Ministry of Labour.

How it works:

- Employer Setup: Companies sign up for the Al Ansari Salary Card Pay Plus service.

- Salary Transfer: Employers transfer employee salaries to Al Ansari Exchange.

- Card Distribution: Employees receive individual Pay Plus cards that are linked to their salary accounts.

- Salary Withdrawal: Employees can use their Pay Plus cards to:

- Withdraw cash from FAB ATMs or Al Ansari Exchange branches.

- Make purchases at any location accepting Mastercard.

Benefits:

- Convenience for workers: Easier access to their salary, eliminating the need to handle cash.

- Security: Reduces the risks associated with cash-based salary payments.

- Efficiency for companies: Simplifies the payroll process and ensures compliance with WPS regulations.

- Wider access: Can serve workers who might not have traditional bank accounts (unbanked or underbanked individuals).

Additional Features:

- Free cash withdrawals at FAB ATMs and Al Ansari Exchange branches.

- Free balance checks at FAB ATMs.

- Potentially other services like money remittance through the Al Ansari Exchange mobile app (depending on the agreement with the employer).

Benefits of the PayPlus Card

- Enjoy free cash withdrawals at Al Ansari Exchange branches and two monthly free withdrawals at FAB ATMs across the UAE.

- Get two free balance inquiries per month at FAB ATMs.

- Access cash withdrawals from any ATM worldwide displaying the MasterCard logo, although charges may apply.

- Easily transfer money at Al Ansari Exchange branches.

- No minimum account balance is required.

- Conveniently make purchases at any outlet or online store globally displaying the MasterCard logo.

- Ensure secure cash withdrawals using your PIN code.

- Access a dedicated call center for card-related inquiries.

- Conveniently receive employees’ salaries through the online portal, eExchange.ae.

- Note: Additional charges of AED 2 apply after two attempts for both cash withdrawals and balance inquiries at FAB ATMs across the UAE.

Benefits of the PayRoll Card

- Enjoy unlimited withdrawals without any limit.

- Accepted at any Al Ansari Exchange branch in the UAE.

- Benefit from enhanced security features, including Chip and OTP.

- Easily receive employees’ salaries through the online portal, eExchange.ae.

- Access dedicated support from a specialized team.

- No issuance fee is charged for the PayRoll Card.

FAQs

How can I verify my Al Ansari Salary Card balance online?

To ascertain your Al Ansari Salary Card balance online, you have two options: you can either utilize the Al Ansari Exchange mobile app or access their official website.

Is there a charge for checking my salary card balance via the Al Ansari Exchange app?

No, typically, checking your Al Ansari Salary Card balance through the mobile app doesn’t incur any fees. It’s a convenient and economical method for monitoring your finances.

Can I inquire about my balance at an Al Ansari Exchange branch instead of using the app or website?

Certainly, you can visit any Al Ansari Exchange branch and seek assistance from their staff to inquire about your salary card balance. They’ll gladly assist you with the balance check.

What should I do if I forget my login details for the Al Ansari Exchange mobile app?

If you happen to forget your login credentials, you can usually utilize the app’s “Forgot Password” or “Reset Password” feature to regain access to your account. Alternatively, you may contact Al Ansari Exchange customer support for further assistance.

Is it secure to check my Al Ansari Salary Card balance through the mobile app?

Yes, generally speaking, it’s safe to check your balance using the official Al Ansari Exchange mobile app. The app is equipped with security measures to safeguard your financial information. Nonetheless, it’s crucial to keep your login credentials private and ensure that you’re using the official app.

![Company Revoke Job Offer Before Joining? [Solution]](https://magicaluae.com/wp-content/uploads/2024/02/Revoke-Job-Offer-Before-Joining-1024x683.jpg)